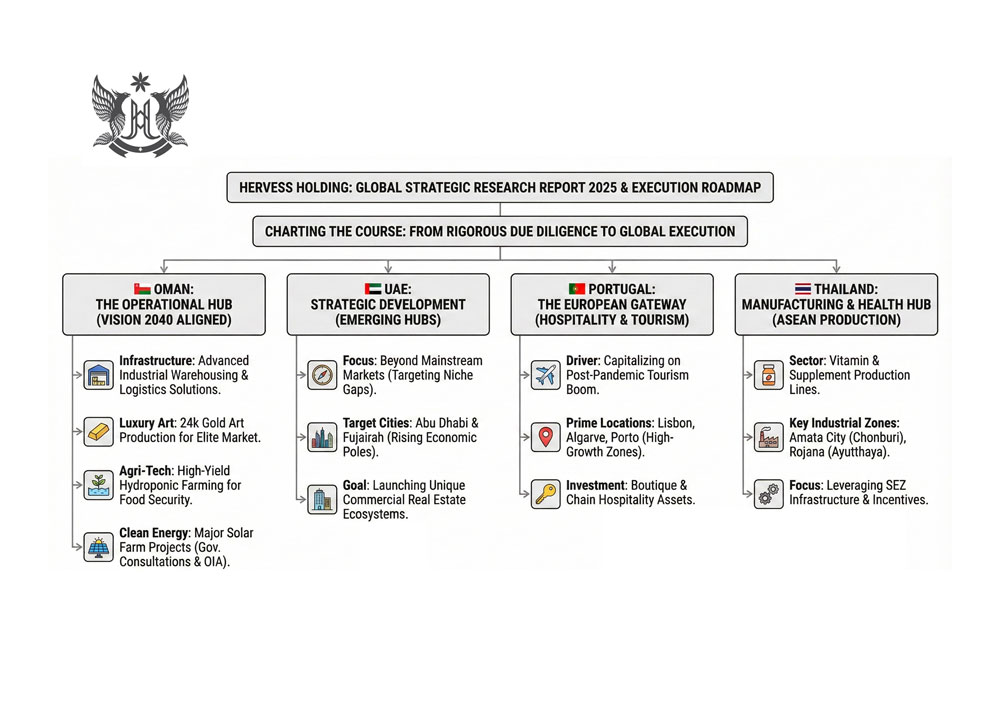

Bridging the gap between rigorous data analysis and executive action, Hervess Holding announces its pivot to large-scale implementation across the MENA, Europe, and ASEAN regions.

MUSCAT & LONDON — December 25, 2025 — Hervess Holding, a premier international investment and development conglomerate, today released its highly anticipated “Annual Strategic Insight Report 2025.” The document details the culmination of over 12 months of intensive on-the-ground research, feasibility studies, and high-level government consultations across four key nations: Oman, the United Arab Emirates, Portugal, and Thailand.

In a global economic climate defined by volatility, Hervess Holding has doubled down on a strategy of “Intelligent Due Diligence.” The report highlights the company’s shift from a phase of aggressive market monitoring to a phase of “High-Impact Execution,” targeting sectors ranging from industrial infrastructure and renewable energy to luxury assets and health manufacturing.

SULTANATE OF OMAN: The Operational Heartland

Aligned seamlessly with Oman Vision 2040, Hervess Holding has identified the Sultanate not just as an investment destination, but as its primary operational nexus. The dedicated R&D team in Muscat has finalized feasibility studies in four critical verticals:

- Industrial Infrastructure & Logistics: Recognizing Oman’s rising status as a global logistics hub, Hervess Holding has completed architectural and financial modeling for next-generation Industrial Warehousing and advanced steel structure manufacturing (Sheds). The research indicates a significant supply gap in Grade-A industrial facilities, which Hervess aims to fill to support the nation’s supply chain resilience.

- The “Golden” Asset Class (Luxury Art): In a move to diversify into alternative assets, the company has concluded market research for the production of 24k Gold-Plated Art Pieces. This initiative targets High-Net-Worth Individuals (HNWIs) in the GCC, positioning fine art not merely as décor, but as a tangible asset class combining cultural heritage with the intrinsic value of precious metals.

- Agri-Tech & Food Security: Responding to the region’s climate challenges, the holding has finalized plans for scalable Hydroponic Farming Systems. The research focused on water-efficient technologies capable of yielding high-quality organic produce, directly supporting Oman’s national food security goals.

- Renewable Energy (Solar): Following constructive high-level dialogues with the Oman Investment Authority (OIA) and electricity regulatory bodies, Hervess Holding has assessed prime land plots for Photovoltaic (Solar) Farms. The technical feasibility study confirms the viability of these projects, leveraging Oman’s world-leading solar irradiance levels.

UNITED ARAB EMIRATES: The “Blue Ocean” Strategy

While the majority of international capital flows toward Dubai’s saturated real estate market, Hervess Holding’s analysts have adopted a contrarian approach, targeting high-growth, underserved corridors:

- Fujairah & Abu Dhabi Focus: The report identifies Fujairah—a strategic bunkering and trade port—and Abu Dhabi—the capital’s rapidly expanding economic zones—as the prime locations for the company’s next commercial venture.

- Commercial Ecosystems: Rather than residential towers, the focus is on developing specialized commercial real estate projects designed to serve the growing influx of businesses and trade entities in these specific emirates.

PORTUGAL: Capitalizing on the European Tourism Renaissance

With European tourism rebounding to pre-pandemic levels, Hervess Holding’s European desk has executed a deep-dive analysis of the Portuguese hospitality sector. The focus is on acquiring and developing assets with high Revenue Per Available Room (RevPAR) potential.

- Strategic Location Scouting: The investment committee has shortlisted three zones:

- Lisbon: Targeting business hotels and urban boutique accommodations.

- The Algarve (Faro & Lagos): Focusing on luxury resort developments catering to the leisure market.

- Porto: Identifying heritage properties for adaptive reuse projects.

THAILAND: The Manufacturing Engine of ASEAN

As global supply chains diversify, Hervess Holding identifies Thailand as the optimal gateway for its manufacturing division, specifically within the Health & Wellness sector.

- Nutraceutical Production Lines: The company has completed regulatory and infrastructural assessments to establish state-of-the-art production lines for Vitamins and Dietary Supplements.

- Industrial Site Selection: Detailed site inspections were conducted at Thailand’s premier industrial estates. The report favors Amata City (Chonburi) and Rojana Industrial Park (Ayutthaya) due to their superior logistics, proximity to deep-sea ports, and incentives offered within the Eastern Economic Corridor (EEC).

A Statement from Leadership

“At Hervess Holding, we do not believe in speculation; we believe in precision. The past year was dedicated to peeling back the layers of these diverse markets to understand the real risks and the real rewards. Today, our data is complete. We know exactly where to build the warehouse in Oman, which plot to acquire in Portugal, and which factory to lease in Thailand. 2025 is no longer about searching; it is about building.”

— Mohammadmahdi Yazdani, Founder & Chairman, Hervess Holding

About Hervess Holding

Hervess Holding is a forward-thinking international investment conglomerate with a diverse portfolio spanning real estate, industrial manufacturing, renewable energy, and luxury goods. With a philosophy rooted in “Investing Beyond Borders,” the company bridges opportunities between the Middle East, Europe, and Asia.